Businesses that sell alcohol must comply with strict legal responsibilities. If you own a bar, liquor store, or restaurant, failing to verify a customer’s age properly can result in hefty fines, license suspensions, or lawsuits. Liquor liability insurance helps protect businesses from claims, but the risk remains if alcohol sales compliance measures are not followed. Your establishment may be sued if it serves alcohol to a minor or an intoxicated person, especially if this leads to property damage, injury, other serious consequences, or deaths.

Relying on staff to manually verify IDs can lead to costly mistakes. Whether it’s misreading a birthdate, overlooking a fake ID, or simply being distracted during a rush, human error is a major risk when it comes to underage sales. ID scanning technology reduces that risk by instantly reading and verifying IDs, flagging expired or suspicious documents, and automating the age verification process. This protects your business, your staff, and your customers—while also speeding up service.

Human judgment alone isn’t always reliable when it comes to tracking how much a guest has had to drink. Monitoring standardized drink unit counts can be a tool to help remind staff to check for signs of intoxication. POS-linked alcohol consumption tracking helps mitigate this risk by automatically flagging when a guest is approaching a consumption limit and require manager overrides for continued service, helping staff make safer, more consistent decisions and greatly reducing liability for the business.

Beyond compliance, ID-scanning technology provides a digital record of every verified ID, helping businesses establish due diligence in case of legal disputes. Incorporating ID scanning into daily operations enhances compliance, safeguards liquor licenses, and may even lower insurance premiums by demonstrating proactive risk management.

Understanding Liquor Liability Protection

Liquor Liability Insurance is a specialized policy protecting businesses from lawsuits related to alcohol-related incidents. If an intoxicated customer causes harm—whether through a car accident, a fight, or property damage—your business could be held liable, even if no direct negligence is proven. Liquor liability insurance helps cover legal fees, settlements, and medical costs related to such claims.

Who Needs Liquor Liability Insurance?

Any business that sells, serves, or permits alcohol consumption should have liquor liability protection, including:

- Bars & Nightclubs – High-risk due to frequent alcohol sales and late-night operations.

- Restaurants – Particularly those with full-service bars or cocktail menus.

- Liquor Stores – Risk of selling to minors or intoxicated customers.

- Event Venues – Weddings, concerts, and private events increase liability risks.

Common Claims Covered:

- Serving Minors – Businesses face severe penalties for selling alcohol to underage individuals, even if they present fake IDs.

- Overserving Intoxicated Patrons – Serving alcohol to a visibly drunk customer can lead to liability if harm occurs.

- Alcohol-Related Accidents – If an intoxicated customer causes a crash, the business may be sued for damages.

One Platform to Automate, Protect, and Comply

WE SCAN is your all-in-one compliance solution for managing alcohol and age-restricted sales. From over-consumption prevention to age verification and private club compliance, we protect your business, your team, and your community.

🔹 POS-Integrated Responsible Service Programs

🔹 Automated Age Verification With Real-Time Alerts

🔹 End-to-End Private Club Management for Dry Jurisdictions

🔹 Policy Enforcement Tailored by Region, Store, or Concept

How Insurance Companies Assess Risk

Insurers evaluate several factors before issuing liquor liability coverage:

- Staff training and software enforcing responsible alcohol service

- ID verification practices

- History of alcohol-related claims or violations

- Use of ID scanning technology to prevent sales to minors

By integrating ID scanning and POS-embedded drink counting, businesses can improve compliance and potentially lower insurance premiums.

The Legal Requirements for Checking IDs

Strict age verification processes are essential to comply with alcohol regulations. U.S. and Canadian laws mandate that businesses confirm the legal drinking age—21 in the U.S. and 18 or 19 in Canada, depending on the province. Failure to comply can result in heavy fines, lawsuits, and liquor license revocation.

Age Verification Laws:

- United States: The Minimum Drinking Age Act (1984) requires all states to enforce a drinking age of 21. Businesses must check IDs and may face liability for serving minors or visibly intoxicated patrons.

- Canada: The legal drinking age is 18 in Alberta, Manitoba, and Quebec and 19 in all other provinces. Liquor control boards regulate alcohol sales, requiring strict compliance with ID-checking laws.

Consequences of Serving Minors:

- Hefty fines for businesses and employees

- Suspension or loss of liquor license

- Civil lawsuits if alcohol consumption leads to injury or death

- Potential criminal charges in severe cases

Many businesses have been shut down due to repeated violations, highlighting the need for strict ID verification procedures.

Take Control of Your Responsible Service Program

Automate age verification, enforce sales policies, and prevent over-consumption—directly through your POS. WE SCAN empowers your business to protect customers, reduce liability, and stay compliant with ease.

🔹 POS-Integrated Age Verification & Alerts

🔹 Real-Time Monitoring for High-Risk Tables

🔹 Fully Configurable by Store, Region, or Brand

🔹 Prevent Lawsuits, License Loss & Over-Serving

Manual ID Checks vs Electronic ID Scanning

| Method | Risks |

|---|---|

| Manual ID Checks | Human error, time consuming, difficulty detecting fake IDs, misreading birthdates, and overlooking expired licenses |

| Electronic ID Scanning | Advanced verification, real-time flagging of expired IDs, and digital compliance records |

By integrating ID scanning, businesses can improve compliance, reduce their risk of serving minors, and strengthen their defense in legal cases.

How ID Scanning Reduces Liability

Traditional ID checks rely on manual inspection, increasing the risk of insurance claims due to human error. ID scanning technology automates age verification and maintains digital records, strengthening compliance and reducing liability risks.

How ID Scanners Detect Fake IDs

Modern ID scanners use barcode scanning to verify ID authenticity. These devices can:

- Scan IDs and cross-check government databases

- Detect alterations, formatting inconsistencies, and mismatches in digital data

- Flag duplicate IDs or suspicious patterns indicating fraud

This makes it much harder for minors to use fake or borrowed IDs.

Time-Stamped Verification Logs as Legal Protection

ID scanning automatically records each scan with a timestamp, creating crucial evidence in case of an investigation or lawsuit. If a business is accused of serving a minor, it can provide digital proof that the ID was verified at the time of sale.

POS Integration for Better Compliance

Our ID scanning and overservice prevention software integrates with point-of-sale (POS) systems such as Toast, Aloha, and Oracle, ensuring that alcohol transactions are linked to verified age data. This prevents employees from overriding age restrictions and strengthens compliance efforts.

Real-Life Case Studies

- Texas Nightclub: Avoided a $10,000 fine when timestamped ID scan records proved compliance.

- California Liquor Store: Successfully fought a lawsuit when an underage decoy was denied alcohol due to ID scanning.

- New York Bar: Reduced liquor violations by 60% after implementing ID scanning, lowering insurance premiums.

Limitations of ID Scanning and How to Address Them

While ID scanning technology significantly reduces the risk of serving alcohol to minors or intoxicated patrons, it isn’t foolproof. Understanding its limitations and implementing best practices can help businesses maximize security while complying with regulations.

Can ID Scanners Be Tricked?

Yes, your employee needs to be an active participant in verifications especially when:

- High-quality fake IDs that are exact replicas of government-issued IDs.

- Borrowed or stolen IDs from someone of legal age.

- Tampered IDs where birthdates are altered but barcodes remain functional.

Staff should always visually compare the ID photo and data with the person presenting it. It is also important to verify the state security features.

Protect Your Business with Smarter Age Verification

Eliminate manual errors and subjective decisions with WE SCAN’s automated age verification solution—designed to secure your business, safeguard your customers’ data, and ensure policy compliance.

🔹 Instantly Verifies All 50 States' IDs

🔹 Works with Your Existing POS or Mobile Devices

🔹 Enforces Custom Age-Based Policies Automatically

🔹 Real-Time Alerts for ID Sharing & Defects

🔹 Built-In Data Protection & Ongoing Support

The Role of Affirmative Defense in ID Scanning

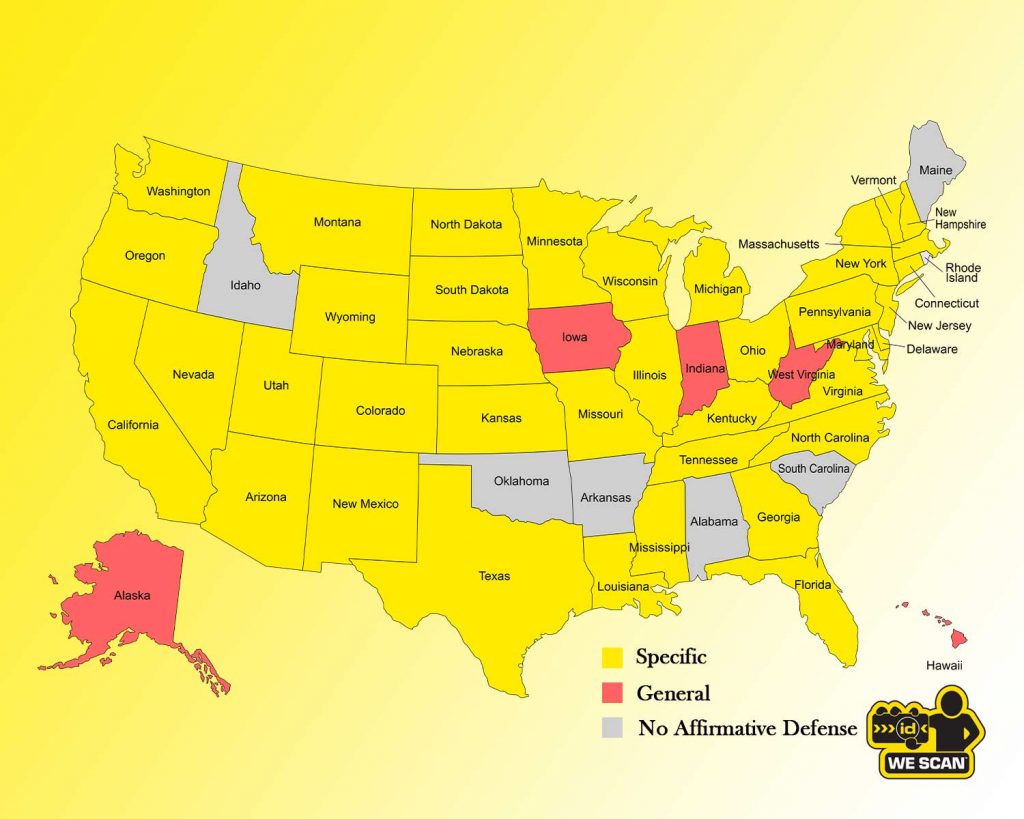

Many states offer Affirmative Defense for businesses that unknowingly sell to minors with fake IDs, provided they reasonably believe the ID is valid. The process includes checking the date of birth, expiration date, and photo. However, distractions and human error increase the risk of mistakes. If a fake ID is scanned and reasonably passed as a valid ID, liability typically is placed upon the user of the fake, as they are committing identity theft.

To strengthen this defense, 11 states, including Arizona, Texas, and New York, explicitly encourage or require electronic ID scanners to verify age and validity.

In yellow – States with specific legislation for retailers to have a specific affirmative defense if a retailer inspects an ID that turns out to be false and reasonably believable based on its appearance.

Best Practices for Using ID Scanning Technology

- Choose ID scanners that ensure compliance with liquor liability insurance requirements.

- Regularly update scanner software

- Establish clear data retention policies to comply with privacy laws.

- Train staff to compare ID photos with customers and recognize suspicious behavior.

- Display signage informing customers about ID scanning for legal compliance.

By combining ID scanning with proper staff training and privacy protections, businesses can minimize risks while ensuring compliance and maintaining customer trust.

FAQs

How does ID scanning help reduce liability in liquor insurance?

ID scanning creates digital records of age verification, helping businesses prove compliance. It prevents sales to minors, reduces human error, and strengthens legal protection in case of lawsuits or insurance claims.

Can ID scanning prevent lawsuits related to underage alcohol sales?

Yes, digital ID verification provides time-stamped proof that a valid ID was checked. This documentation can help defend against claims, reducing legal risks and potential fines for serving alcohol to minors.

Does using an ID scanner lower my liquor liability insurance premiums?

Many insurers offer lower premiums to businesses using ID scanning technology. It demonstrates proactive risk management, reducing the likelihood of claims related to underage sales or intoxicated patrons.

What features should I look for in an ID scanning system for compliance?

Look for age verification, fake ID detection, time-stamped records, and POS system integration. Automatic alerts for expired or underage IDs enhance compliance and help prevent illegal alcohol sales.

Is ID scanning legally required for liquor-serving businesses?

ID scanning isn’t always legally required but is highly recommended. Some states and provinces mandate electronic age verification, while others allow manual checks. Always follow local alcohol compliance regulations.